As a Canadian freelancer, I found myself constantly searching for a fast, reliable way to calculate Harmonized Sales Tax (HST) — not just for Ontario, but also for provinces like Nova Scotia and PEI. Every time I had to invoice a client or check how much tax was included in a total amount, I ended up doing manual math or clicking through cluttered government sites.

That frustration led to a simple idea: build a tool that does exactly what I need, without distractions.

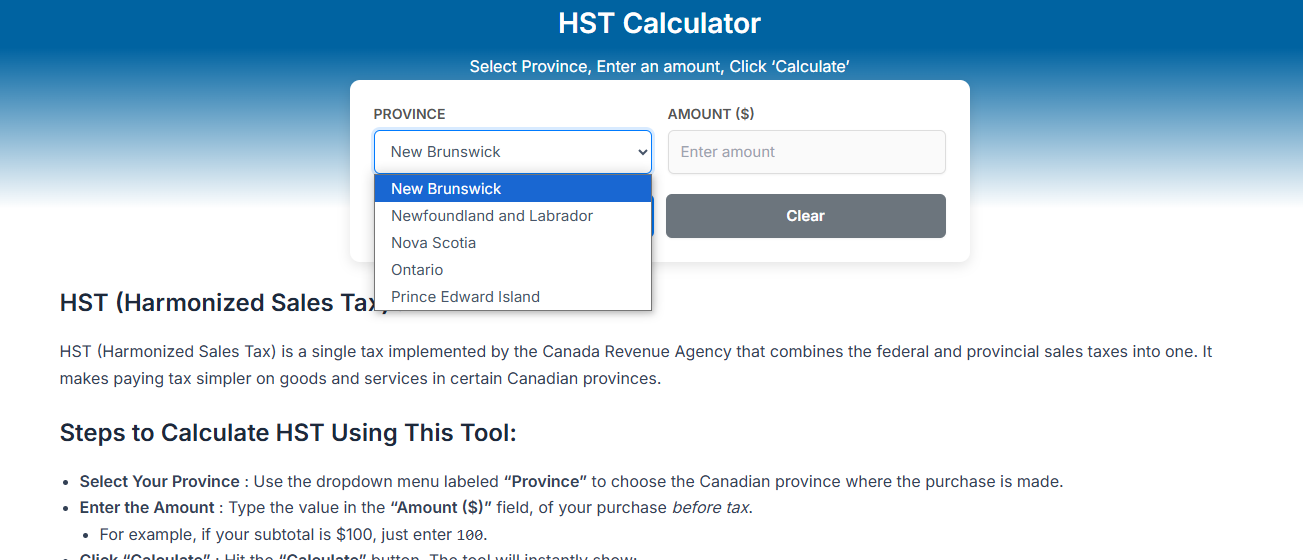

So I created HSTCalculator.onl, a free online utility that lets anyone instantly add or remove HST based on province-specific rates. Whether you’re a business owner, a freelancer, or just shopping online, the tool helps you calculate:

Net amount (before tax)

HST amount (based on selected province)

Total amount (after adding tax)

No signup. No ads. Just accurate results in one click.

It’s built with simplicity in mind — works on desktop and mobile, loads instantly, and respects your privacy (no data is collected). As of now, the tool supports all HST provinces:

Ontario – 13%

Nova Scotia – 15%

New Brunswick – 15%

Newfoundland and Labrador – 15%

Prince Edward Island – 15%

This project was created under my developer identity, Tara Rebecca, as part of my mission to build helpful micro-tools that solve everyday problems.

If you’ve ever felt confused about how much HST you’re paying — or want to double-check before sending an invoice — give it a try:

Feel free to share it with fellow Canadians who could use a reliable HST calculator.

Tags: #HSTCalculator #CanadianTax #SmallBusinessTools #FreelancerFinance #Taxcaluclator

Write a comment ...